Here’s why Earnium might be one of the most promising entry points into Aptos DeFi👇

Liquidity pools are spitting hot returns :![]()

$USDT/$USDC → 22% APR

$APT/$kAPT → 19% APR

$APT/![]()

![]() → 105% APR

→ 105% APR

$APT/![]()

![]() → 101% APR

→ 101% APR

$APT/![]() → 433% APR ($CANCER)

→ 433% APR ($CANCER)

Others still holding strong above 100%.

Small TVL + surging volume → early movers could capture serious upside.

On top of that, Earnium launched a Gas Fee Cashback campaign (ends Sep 30).

![]() Trade & pay gas

Trade & pay gas

![]() Get 100% cashback in $USE

Get 100% cashback in $USE

Basically, you can trade & farm at zero net cost while growing liquidity in pools that already have juicy APRs.

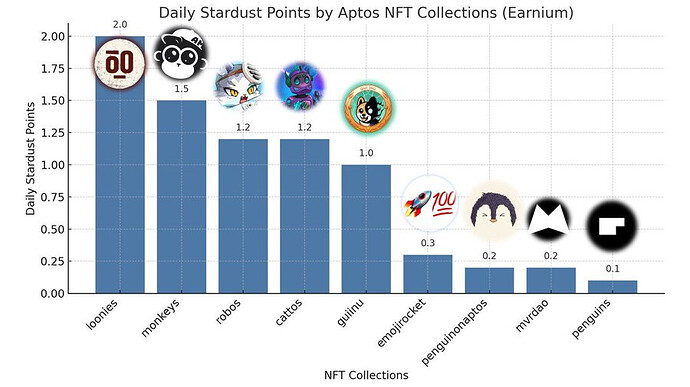

And if you’re into NFTs, Earnium adds another layer → daily Stardust points for holders of top Aptos collections:

Theloonies_nft (2 pts)

AptoRobos (1.2 pts)

AptosMonkeys (1.5 pts)

guiinuonaptos (1 pt)

… and more.

So swapping on Earnium isn’t just DeFi, it’s a whole ecosystem play.

Earnium is blending:

High-yield LPs

Gas cashback rewards

NFT integrations(Stardust points)

Rapidly growing trading volume

The market’s volatile, always DYOR, but for Aptos DeFi explorers, Earnium looks like one the best early-stage right now.