Between Aries market and Aptinlabs which do you consider the best Lending and borrowig protocol?

leave your thoughts in the comments and why

Between Aries market and Aptinlabs which do you consider the best Lending and borrowig protocol?

leave your thoughts in the comments and why

They both are similar and trusted

very good

![]()

![]()

![]()

![]()

![]()

Both are good to go

both are great–if you’re good at balancing lend/borrow positions it is a great idea to use them in synergy and take advantage of rates

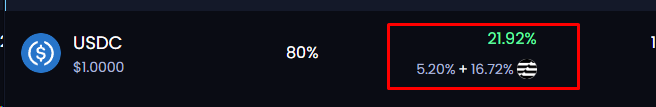

here’s an example (apy rates as of 24/3/24 23:48 UTC, note that most are temporary due to each platform’s ongoing events):

deposit usdc to aries

then borrow zusdt from aries

next, deposit the borrowed zusdt to aptin

then borrow another asset with low borrow apy on aptin that also has a high deposit apy in aries, say usdc, and you can keep the cycle going to some extent, just be mindful of the transaction costs. goes without saying that this works more effectively the higher the asset amount and you have to keep into consideration the health factor/risk factor

the only disadvantages are: 1, you have to monitor your positions regularly (pain in the a$$ tbh) and 2, degens may overextend their positions and cause a liquidation cascade

try half in each one

I am trying both

i almost forgot, you should also check out echelon market

supply yield is quite low, but the borrow rates are pretty good though

it is another unique smart contract and another tokenless dapp you can interact with, so why not

Thanks for this info

im interested in getting in to this, unfortunately i dont have a lot of money, is that a problem?

great summary of risks and potential rewards, thanks for sharing this understanding.

Hey guys

Any suggestions where I should start with lending/borrowing protocols?

Which dApps are the best? ![]()

Both are great.

Both are outstanding

Aptos amazing

In my opinion, Aptin is the best.

aries is better when not bugging out. can get two for one airdrops

Thanks for sharing bro